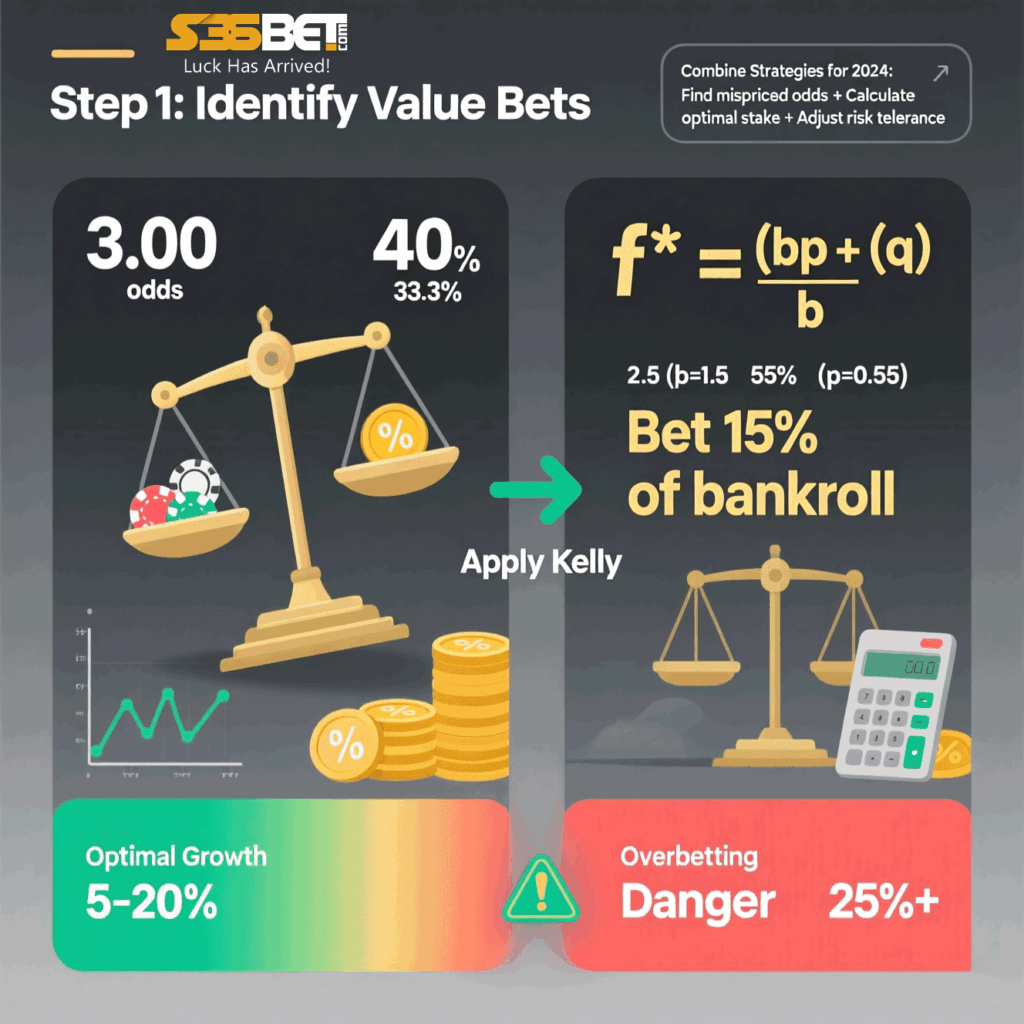

What is the Kelly Criterion?

Developed by John L. Kelly Jr., this formula determines the optimal stake size based on edge and bankroll to maximize growth while minimizing risk.

Formula:

f∗=bbp−q

- f∗= fraction of bankroll to bet

- b= decimal odds – 1

- p= probability of winning

- q= probability of losing (1 – p)

Example:

- Odds: 2.50 (b = 1.5)

- Estimated win probability: 55% (p = 0.55, q = 0.45)

- Calculation: f^* = \frac{(1.5 \times 0.55) – 0.45}{1.5} = 0.15 \text{ (15% of bankroll)}

Pros & Cons:

✅ Minimizes risk of ruin while maximizing growth.

❌ Overestimating edge can lead to heavy losses.

Final Thoughts

Both strategies require discipline and data analysis. Value betting works best for long-term profitability, while the Kelly Criterion helps manage risk effectively. Combining them can lead to a powerful betting approach in 2024.

Would you like a deeper dive into any specific strategy? 🚀