The UK government’s proposal to reform remote betting tax has ignited a nationwide debate across the gambling industry, policymakers, and consumer groups. With potential tax hikes threatening up to £160 million in annual costs for bookmakers, the racing sector faces significant financial pressure. As concerns mount over increased black-market activity and weakened market regulation, the upcoming Autumn Budget is set to determine whether the reform will safeguard or destabilize one of the world’s most regulated gambling environments.

Remote Betting Tax Reform Sparks Industry Disruption and Policy Debate

Core Issue Overview

The UK Treasury is considering a reform to unify different types of remote betting duty, sparking intense debate among industry stakeholders, lawmakers, and public interest groups. The proposed changes could significantly impact the horse racing sector, fuel black-market growth, and expose a deep philosophical divide over the purpose of gambling taxation: revenue generation versus social responsibility.

Potential Financial Impact

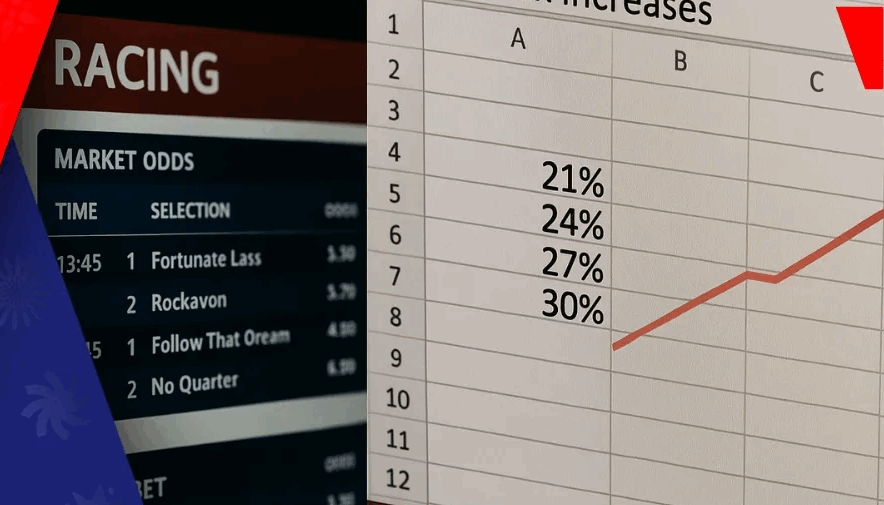

According to modelling by the British Horseracing Authority (BHA), bookmakers could face up to £160 million (€188 million) in added annual costs solely from racing bets. Key concerns include:

- Proposed duty rates of 21%–40%: These may force operators to reduce or exit betting on racing.

- Racing’s financial fragility: Unlike casinos or slots, racing depends on a delicate mix of betting revenue, media rights, and sponsorships.

- Economic consequences: Over £350 million (€411 million) is reinvested into the sport annually through levies, supporting thousands of jobs across the industry.

Disagreement Over Tax Purpose

There is no consensus on the purpose of gambling taxes, which drives conflicting views on how they should be structured:

- Is the tax meant to raise revenue, guide behavior, or offset social harm?

- Consumer groups have called for stronger oversight but have mostly stayed silent during this consultation.

- If harm reduction is the goal, steep tax hikes may push users to offshore operators, increasing the very risks the policy seeks to mitigate.

Channelisation Concerns in the UK

Channelisation—steering consumers to licensed operators—remains high in the UK at 92% to 98%, but it is fragile:

- France’s unpopular reforms saw legal player retention drop below 60%.

- In Brazil, a six-point tax rise led to immediate industry pushback.

- Similar changes in the UK could weaken the legal market and empower illegal operators.

The BHA has already raised concerns about a 522% surge in illegal horseracing betting since 2021, highlighting the risks of reduced market competitiveness.

Simplicity vs. Regulation Effectiveness

The Treasury’s consultation reflects a core regulatory tension:

- The current three-tier system is complex and potentially riddled with loopholes.

- However, applying a flat, casino-level duty to all forms of betting could devastate racing and shift players toward higher-margin, riskier gambling products.

Labour MP Alex Ballinger supports harmonisation but warns that it might prompt operators to push players into casino offerings, potentially undermining the intended policy outcomes.

What Comes Next: Autumn Budget Decision Point

The final decision is expected in the October 2025 Autumn Budget. More important than the policy itself may be the debate it has ignited. Key questions include:

- What is the UK’s guiding philosophy on gambling taxation?

- Can the Government balance simplicity, fairness, and industry sustainability?

- Will the reform protect the regulated market or harm a national sporting tradition?